Power Purchase Agreement (PPA)

A Solar Power Purchase Agreement (PPA) is a legal contract between an organization (school, church, government, business, etc.) and a for-profit company, often a Limited Liability Company (LLC), that allows an organization to access solar without constructing and paying for the solar system.

Because they had no taxable income, PPAs were traditionally used by non-taxpaying organizations to obtain solar electricity while still making use of the federal tax credit. This has changed because now a non-taxpayer can receive the credit as a direct cash payment instead of a credit.

It can also be used to obtain solar electricity when an organization cannot fund the construction of the solar project by itself, or doesn’t want to go through the process of installing their own system.

A PPA is very similar to a solar lease. The leasing option is usually used by individual homeowners while the PPA is usually used by organizations.

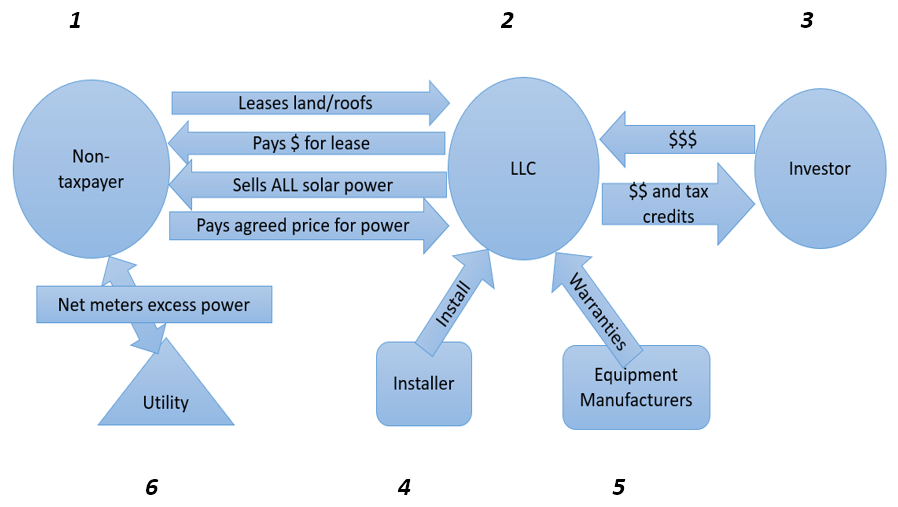

To help you understand a PPA, below is a schematic of the structure of a PPA.

1) The organization that wants to receive solar power (church, government building, school, business, etc.). We will call it “non-taxpayer” (NT) although it can be a taxable entity such as a business.

2) Limited Liability Company (LLC) is the entity that will build and own the solar system. The LLC is set up to be taxed as a partnership with income and expenses flowing through the LLC to the investors, including the 30% federal tax credit. So, the investors receive the 30% federal tax credit.

The electricity generated by the LLC is provided to the NT. The term is for a predetermined number of years (e.g. 20 years). The NT agrees to buy all of the electricity generated by the LLC.

The NT usually has the right to ”call” the contract and negotiate to buy the system after a specific time period, usually at below the initial cost of the system. Note that the buyout price cannot be agreed to in advance. At this point, the NT owns the system and ceases to pay the LLC for power and is responsible for maintenance and insurance. If the contract is not renewed and the system is not sold, the LLC will remove the solar installation at the end of the contract period.

3) The investor(s) invests money in the LLC to construct the solar system. There can be one or multiple investors. The investor(s) can be local residents such as members of a church or investors that the solar company has brought to the project.

Potential investors need to know the different between passive and active investments and how they impact the tax credits they receive.

The LLC may build the solar system on property (roof, adjoining land, etc.) owned by the NT. In return, the LLC may pay rent for using the NT property.

4) An installer is hired to build and maintain the solar system for the term of the contract.

5) Warranties are signed as to the maintenance of the system and other issues.

6) The Non-Taxpayer will work with the utility on the interconnection of the system to the electrical grid and the net metering of excess power.